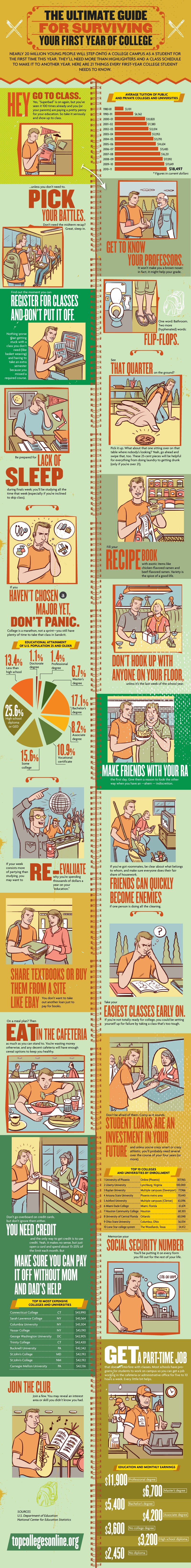

The editors at Top Colleges Online put together following guide for helping you navigate the first year of college.

THE ULTIMATE GUIDE FOR SURVIVING YOUR FIRST YEAR OF COLLEGE

Nearly 20 million young people will step onto a college campus as a student for the first time this year. They'll need more than highlighters and a class schedule to make it to another year. Here are 21 things every first-year college student needs to know.Hey, go to class. Yes, 'Superbad' is on again, but you've seen it 100 times already and you (or your parents) are paying a pretty penny for your education. So take it seriously and show up to class.

... unless you don't need to. Pick your battles. Don't need the midterm recap? Great, sleep in.

Get to know your professors. It won't make you a brown-noser; in fact, it might help your grade.

One word: Bathroom. Two more (hyphenated) words: Flip-flops.

Find out the moment you can register for classes and don't put it off. Nothing worse than getting stuck with a class you don't need (like basket weaving) and having to take an extra semester because you missed a required course.

See that quarter on the ground? Pick it up. What about that one sitting over on that table where nobody's looking? Yeah, go ahead and swipe that, too. These 25-cent pieces will be helpful for everything from doing laundry to getting drunk (only if you're over 21).

Be prepared for lack of sleep during finals week; you'll be studying all the time that week (especially if you're inclined to skip class).

Fill your recipe book with exotic items like chicken-flavored ramen and beef-flavored ramen. Variety is the spice of a good life.

If you haven't chosen a major yet, don't panic. College is a marathon, not a sprint-you still have plenty of time to take that class in Sanskrit.

Don't hook up with anyone on your floor, unless it's the last week of the school year.

Make friends with your RA the first day. Give them a reason to look the other way when you have an - ahem - indiscretion.

If your week consists more of partying than studying, you may want to re-evaluate why you're spending thousands of dollars a year on your 'education.'

If you've got roommates, be clear about what belongs to whom, and make sure everyone does their fair share of housework. Friends can quickly become enemies if one person is doing all the cleaning.

Share textbooks or buy them from a site like eBay; you don't want to take out another loan just to pay for books.

Take your easiest classes early on. If you're not totally ready for college, you could be setting yourself up for failure by taking class that's too tough.

Don't be afraid of them. Corny as it sounds, student loans are an investment in your future, and unless you're crazy smart or crazy athletic, you'll probably need several over the course of your four years (or more).

On a meal plan? Then eat in the cafeteria as much as you can stand to. You're wasting money otherwise, and any decent cafeteria will have enough cereal options to keep you healthy.

Don't go overboard on credit cards, but don't ignore them either. You need credit, and the only way to get credit is to use credit. Yeah, it makes no sense, but just open a card and spend about 15-20% of the limit each month. But make sure you can pay it off without mom and dad's help.

Memorize your Social Security number; you'll be putting it on every form you fill out for the rest of your life.

Join the club. Join a few. You may reveal an interest area or skill you didn't know you had.

Get a part-time job that doesn't interfere with classes. Most schools have programs for students to work on campus so you can get a job working in the cafeteria or administrative office for five to 10 hours a week. Every little bit helps.

Average tuition of public and private colleges and universities

1980-81

$3,101

1990-91

$6,562

2000-01

$10,820

2001-02

$11,380

2002-03

$12,014

2003-04

$12,953

2004-05

$13,793

2005-06

$14,634

2006-07

$15,483

2007-08

$16,231

2008-09

$17,092

2009-10

$17,649

2010-11

$18,497

* Figures in current dollars

Educational attainment

Doctorate degree 1.1%

Professional degree 1.4%

Master's degree 6.7%

Bachelor's degree 17.1%

Associate degree 8.2%

Vocational certificate 10.9%

Some college 15.6%

High school completion 25.6%

Less than high school 13.4%

Education and earnings

Professional degree

$11,900/month

Master's degree

$6,700/month

Bachelor's degree

$5,400/month

Associate degree

$4,200/month

No college degree

$3,600/month

High school diploma

$3,200/month

No diploma

$2,450/month

Top 10 colleges and universities by enrollment

1 University of Phoenix Online (Headquarters in Phoenix) 307,9652 Liberty University Lynchburg, Virginia 100,000

3 Kaplan University Multiple campuses (Headquarters in Davenport, Iowa) 77,966

4 Arizona State University Phoenix metro area 70,440

5 Ashford University Multiple campuses (Headquarters in Clinton, Iowa) 63,096

6 Miami Dade College Miami, Florida 61,674

7 Houston Community College Houston 60,303

8 University of Central Florida Orlando 60,048

9 Ohio State University Columbus, Ohio 56,054

10 Lone Star college system The Woodlands, Texas 54,412

Top 10 most expensive colleges and universities

Connecticut College CT $43,990Sarah Lawrence College NY $43,564

Columbia University NY $43,304

Vassar College NY $43,190

George Washington University DC $42,905

Trinity College CT $42,420

Bucknell University PA $42,342

St John's College MD $42,192

St John's College NM $42,192

Carnegie Mellon University PA $42,136

SOURCES

U.S. Department of Education

National Center for Education Statistics